New Jersey surcharge program charges extra fees from drivers for specific traffic violations and impose excessive points. This NJSurcharge guide discusses about the program and gives short details about the payment plans.

The NJSurcharge program operates independently of other traffic violations and court fees in NJ. Violation drivers such as DUI or driving without insurance have to pay substantial yearly surcharges, that is paid in 3 years. Even accumulated points can trigger charges.

This article describes all the important information in a logical manner to avoid confusion and stress. Authentic advice enables readers of PayNJMC.com to make payments in the correct way. Payment plans offer monetary flexibility too.

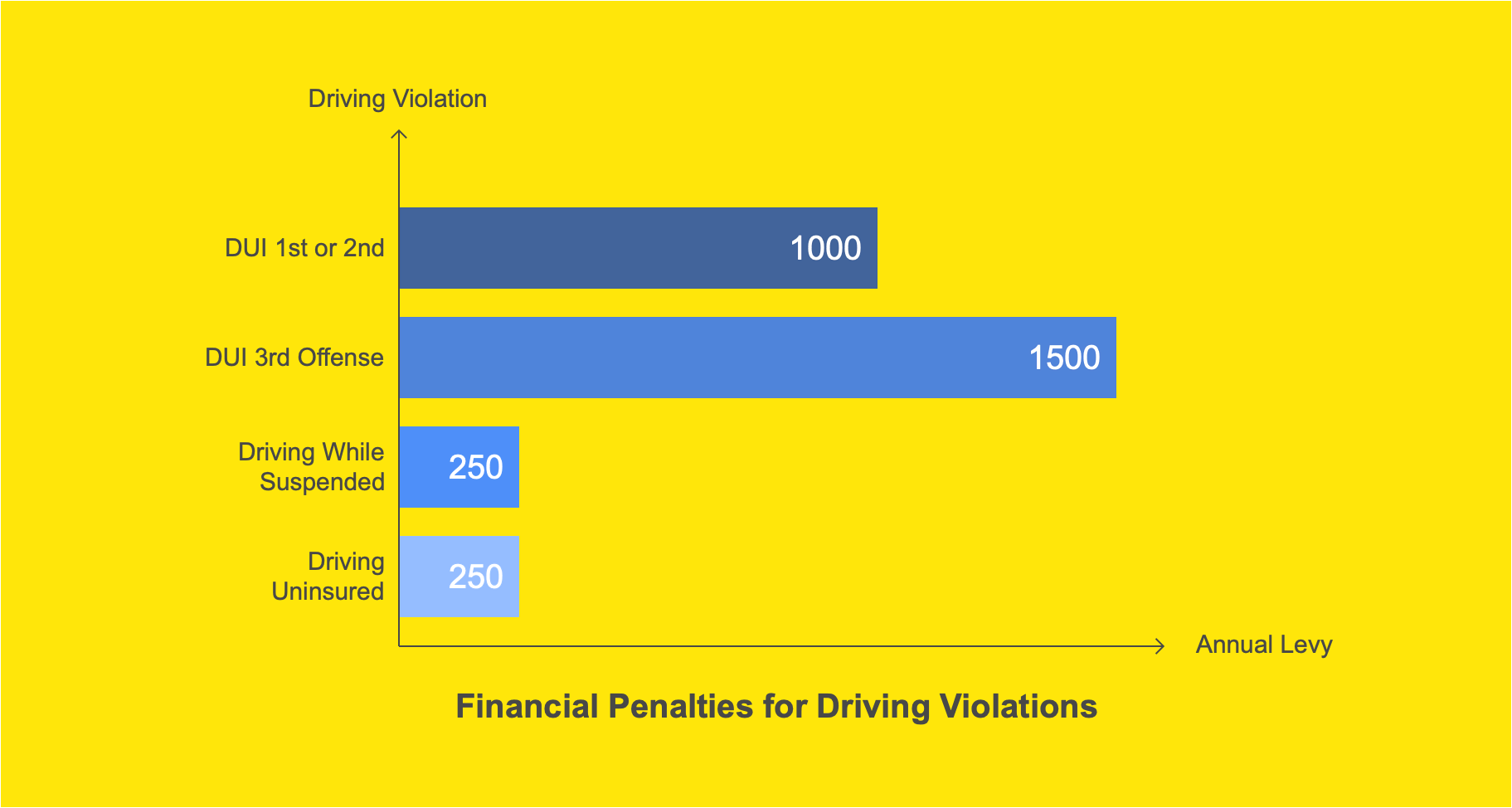

| Violation Type | Annual Surcharge (3 Years) |

| DUI 1st or 2nd Offense | $1,000 |

| DUI 3rd Offense (in 3 years) | $1,500 |

| Driving While Suspended | $250 |

| Driving Uninsured | $250 |

What is the NJSurcharge System?

New Jersey’s unique surcharge system generates significant revenue through fees intended to improve public safety. The point system for traffic infractions and set penalties aim to curb offenses by attaching financial consequences.

All insured drivers are responsible. Motor Vehicle Commission (MVC) bills annually for a period of 3 years. Bankruptcy was not able to immunize motorists from their surcharge obligations, under New Jersey law (N.J.S.A. 17:29A-35).

Purpose and Function

- Deter Unsafe Driving: The primary goal is promoting roadway safety

- Revenue Generation: Funds various MVC programs

- Accountability: Holds drivers responsible for actions

Who Pays New Jersey Surcharges?

New Jersey citizens and non-resident drivers may be subject to surcharges for certain offenses. Responsibility is applied equally under laws enacted by a democratic government.

| Driver Type | Violation Triggers | NJSurcharge Details |

| In-State | 6+ points on NJ license Specific offenses like DUI/DWI | See tables below for fees & durations |

| Out-of-State | Accumulating points during NJ operation | Equal rules as for NJ licensees |

| All Motorists | Particular serious violations | Financial penalties even for first-time offenses |

Distinct surcharge of NJMC system imposes economic sanctions on non-resident drivers in the same way as residents are. Non-resident drivers operating in New Jersey, upon conviction for DUI, will be subject to the $1,000 per year surtax statewide statute requires. Courts make no home-state distinctions.

You are still required to pay surcharges even after your departure from New Jersey. Surcharges apply irrespective of present license, registration, or insurance.

Point-Based Violations

| Points | Surcharge |

| First 6 | $150 |

| Over 6 | $25 per additional point |

Surcharges are assessed against drivers who accumulate 6+ points in the preceding three-year period. The accumulation of points is calculated as of the date the point violation is posted to the driver history record.

Points reductions issued for violation-free driving or completing approved courses are not considered when assessing surcharges.

Offense-Specific Penalties

| Violation | Duration | Annual Levy |

|---|---|---|

| DUI 1st or 2nd | 3 years | $1,000 |

| DUI 3rd Offense | 3 years | $1,500 |

| Driving While Suspended | 3 years | $250 |

| Driving Uninsured | 3 years | $250 |

| Unlicensed driver | 3 years | $100 |

| No insurance – MOPED | 3 years | $100 |

If convicted of both drunk driving and refusal resulting from the same arrest, you will only receive one surcharge.

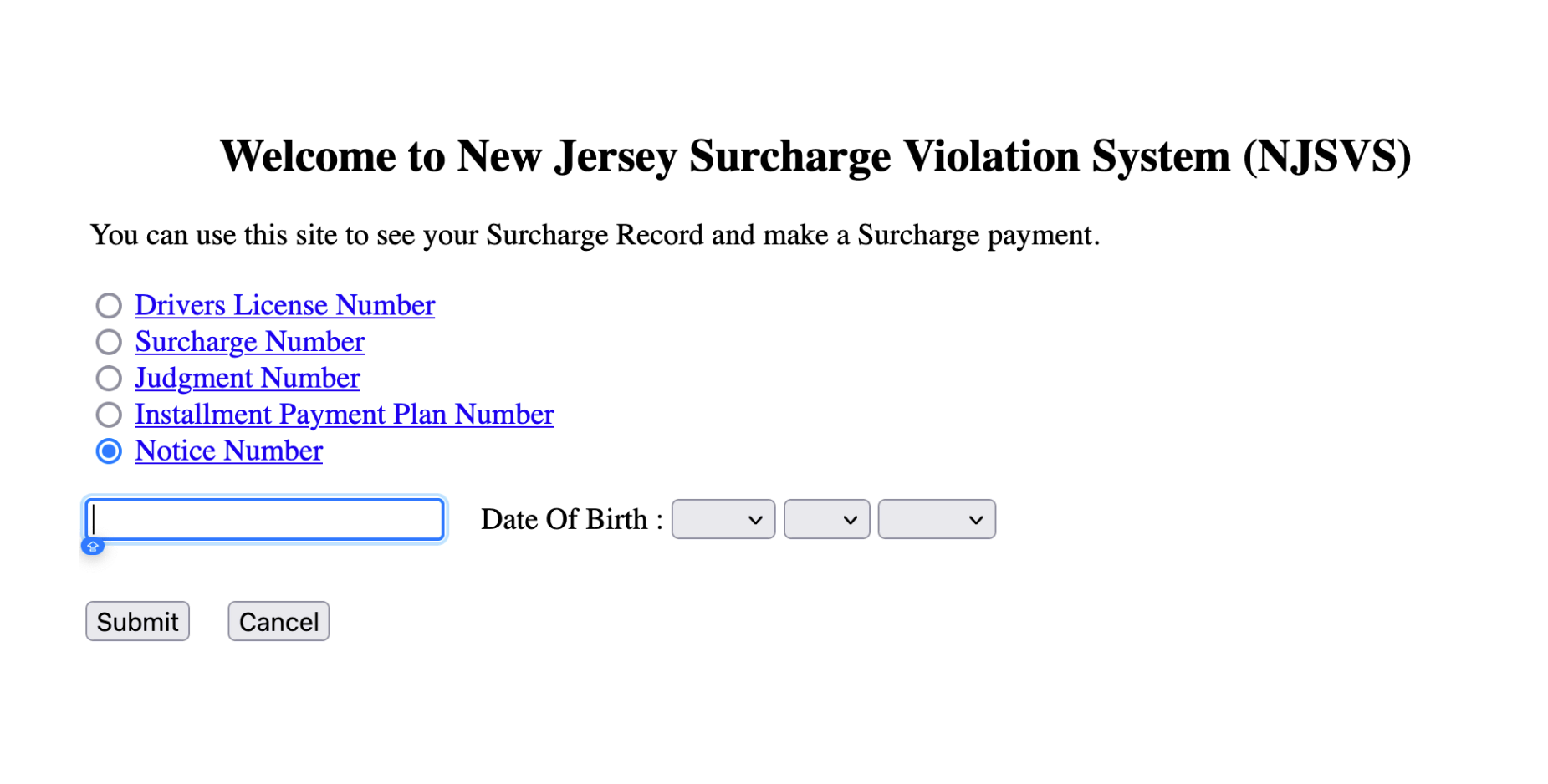

Payment Options for NJ Surcharges

Drivers have flexible ways to remit fees with ease:

| Method | How It Works |

| Online | Pay via NJSVS – Pay By Web (state.nj.us) using MasterCard, VISA, Discover, or e-Check |

| Phone | Call (844) 424-6829 for automated payments 24/7 or speak with representatives 8 AM to 5 PM, Monday-Friday |

| Send bottom portion of notice with check or money order to: New Jersey Surcharge Violation System, P.O. Box 1502, Moorestown, NJ 08057-9704 | |

| In-Person | Pay at NJMVC Regional Service Centers using credit cards, cash, check, or money order |

Installment plans for unpaid fees in place. Call (844) 424-6829 to discuss customized payment timelines.

Consequences of Non-Payment

Not paying New Jersey surcharges can have negative effects on drivers. The State’s Set Off of Individual Liability (SOIL) program permits the State to deduct tax refunds or other money owed to you by the State in place of paying past-due surcharge balances. This enables New Jersey to collect debts aggressively.

In addition, surcharge non-payment can result in indefinite license suspension until all outstanding fees and interest charges are remitted. Drivers must pay $100 restoration fees to reissue driving licenses following debt payments. Criminals who are referred to collection agencies in the private sector suffer credit standing dents too.

Moreover, additional penalties like steep late fees, legal action, and even wage garnishment may happen per New Jersey’s SOIL guidelines. Certificates of Debt could be filed in court, leading to further civil and criminal liability. Bank account levies are also options the State can exercise.

Overall, prompt surcharge payment as charged avoids hefty financial penalties and lawsuits. Problem drivers are encouraged to call (844) 424-6829 and request payment plans. But ignorance or avoidance exacerbates issues. Payment of all traffic violation fees in good standing is recommended, although New Jersey’s surcharging system is unique.

Managing NJSurcharges

Navigating New Jersey’s complex surcharging system requires awareness and action.

Installment Payment Plans

The State realizes that timing problems regarding cash flow may lead to non-payment. Accordingly, the flexibility of tailored installment plans is presented, and one can pay balances in months or years if not capable of making lump sums up-front.

To be put on an Installment Payment Plan (IPP), you first pay the installment payment amount listed on the front of your notice by the due date. Any remaining surcharge balance will be paid in monthly installments. But judgments will still be outstanding until paid in full.

For arrangements, dial (844) 424-6829. Advisors consider individual circumstances on a case-by-case basis for win-win accommodations.

Change of Address Requirements

Surcharge notices are sent to the last known address that you have on file with the Motor Vehicle Commission (MVC). You are always required to have an up-to-date mailing address on file with the MVC. If you relocate, you are legally required to notify the MVC within seven days. Changing your address with the U.S. Postal Service does not change it with the MVC.

You can update your address:

- On the web: www.njmvc.gov

- By mail: MVC Change of Address Database Corrections Unit, P.O. Box 141, Trenton, NJ 08666-0141

Judgment Information

To satisfy a judgment debt, all payments must be made in certified funds (U.S. Postal money order, attorney trust account check, or certified bank check). All uncertified payments (personal check, credit card) will delay the filing of a Warrant of Satisfaction by two months.

Dishonored Payments

All checks returned for insufficient funds or reversed credit card charges will be subject to a $25.00 dishonored payment fee.

Recent Legislative Updates

A new bill (S1522) aims to mandate installment payment options more broadly:

- Up to 4 years for surcharge assessments under $2,300

- Up to 6 years for amounts above $2,300

This provides standardized rules for payment term allowances instead of leaving to MVC discretion. The extended windows let motorists resolve financial obligations slowly without risking license revocation penalties immediately.

Bankruptcy Considerations

Although individual bankruptcy filings in New Jersey limit some of the obligations, the surcharges remain potentially collectible. Official documents show that although you may be able to file bankruptcy, you will likely still be liable for your surcharges. Consult attorneys to understand the implications fully.

License Restoration

If your driver license was suspended or in suspended status prior to January 1, 2021, you are still liable for all unpaid surcharges and payment of the $100 driver license restoration fee prior to reinstatement of your driving privileges.

In short, New Jersey years ago enacted a law implementing a additional surcharging system to impose severe financial penalties on risky driving practices. All licensed motorists are held responsible under this regime of policy.

The State MVC bills you what you owe. They do, though, allow you to pay into plans. Drivers can avoid fees with timely payment. Advisers’ discussions can leave you with a plan under budget. The system works to make roads safer and bring in revenues, which is controversial. But most officials believe that it does both the right way. The extra fees changed how drivers think and pay for necessary transportation projects.

By following the fee guidelines, making prompt payments, and defensive driving, life in New Jersey is easy. Payment plans prevent racking up excessive fees and complying with the laws. Overall, the program rewards safe driving.